Table of Contents

| 🏢 Company Name: | Netrios Ltd / Netrios LP Ltd |

| 🌐 Website: | athensmarkets.co |

| 📍 Supposed Address: | Fortgate Offshore Investment & Legal Services Ltd, Ground Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia / Trident Chambers, P.O. Box 146, Road Town, Tortola, British Virgin Islands |

| 📞 Phone: | - |

| ✉️ Email: | [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

Introduction

Athens Markets is an online forex trading platform that offer access to various currency pairs. However, its offshore operations and lack of regulatory oversight raise questions about its legitimacy and safety for investors.

Athens Markets Regulatory Red Flags

AthensMarkets.co operates under the umbrella of two offshore companies: Netrios LP Ltd, registered in Saint Lucia, and Netrios Ltd, registered in the British Virgin Islands (BVI). These jurisdictions are known for their lax regulatory environments, often attracting companies seeking to avoid stricter financial oversight.

Netrios LP Ltd, registered in Saint Lucia, is not regulated by the Financial Services Regulatory Authority (FSRA), the financial watchdog of Saint Lucia. Additionally, the FSRA has stated that forex trading activities are not regulated within Saint Lucia’s territory.

Netrios Ltd, registered in the British Virgin Islands, is not regulated by the British Virgin Islands Financial Services Commission (BVI-FSC). Indeed, we did not find any track record of Netrios Ltd on the FSC register.

Despite being registered offshore, Athens Markets does not hold any legitimate regulation from any recognized financial authority. This lack of oversight raises significant red flags for potential investors, as it means there are no safeguards in place to protect their funds or ensure fair trading practices.

Athens Markets Features and Offers

Trading accounts:

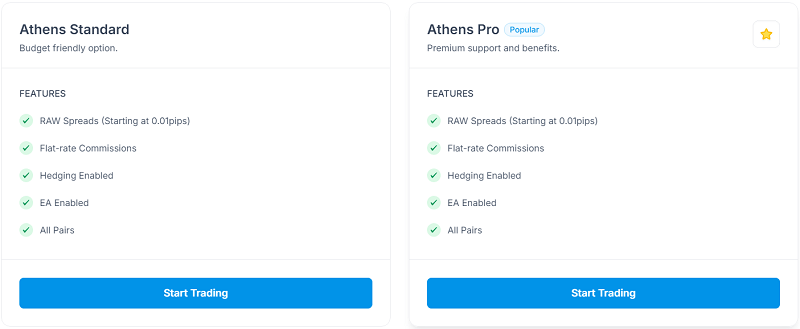

AthensMarkets offers three account types: Demo Account, Athens Standard, and Athens Pro. While the demo account allows for risk-free practice, the live trading accounts come with limited transparency regarding crucial trading conditions.

The lack of information on minimum deposit requirements and leverage options for live accounts is concerning. These are essential details that traders need to make informed decisions about their investment and risk exposure.

Deposit and Withdrawal

Another concern is the limited deposit and withdrawal methods. Athens Markets only accepts cryptocurrencies, specifically BTC, ETH, USDT ERC20, and USDC ERC20. This could pose challenges for traders who prefer traditional payment methods or those who are not yet familiar with the crypto world.

Customer Service

AthensMarkets offer 24/7 customer support via a ticketing system within their client area. However, there’s no mention of alternative contact methods like phone or live chat. which might be a concern for traders who prefer more immediate assistance.

Conclusion

Athens Markets raises serious red flags due to its unregulated status and lack of transparency. The platform’s offshore base, limited deposit options, and absence of crucial trading information should serve as a clear warning to potential investors.

FAQ

Is Athens Markets a regulated broker?

No, Athens Markets is not regulated by any recognized financial authority.

What are the account types available on Athens Markets?

Athens Markets offers three account types: Demo Account, Athens Standard, and Athens Pro.

What deposit methods does Athens Markets accept?

Athens Markets exclusively accepts deposits in cryptocurrencies, which may not be convenient for all traders.

Should I invest with Athens Markets?

Given the lack of regulation, questionable transparency, and offshore operations, it is strongly advised to avoid Athens Markets.