| 🏢 Company Name: | Winfxmarkets Ltd |

| 🌐 Website: | winfxmarkets.com |

| 📍 Supposed Address: | 11-13 Slingsby Place, London, England, WC2E 9AB |

| 📞 Phone: | +447537170834 +447418604210 |

| ✉️ Email: | [email protected] [email protected] [email protected] |

Winfxmarkets presents itself as a sophisticated online forex broker, attracting traders with promises of a user-friendly platform, diverse trading instruments, and access to leverage. However, beneath this veneer of legitimacy lies a web of deception and potential financial risks.

Accounts Overview

Winfxmarkets offers a tiered account structure, ranging from Basic to Exclusive, each with varying minimum deposits and spreads:

| Account Type | Minimum Deposit | Spread | Instruments |

|---|---|---|---|

| Basic | $200 | 1.6 pips | 50+ |

| Silver | $5,000 | 1.3 pips | 150+ |

| Gold | $20,000 | 0.9 pips | 300+ |

| Platinum | $50,000 | 0.6 pips | 500+ |

| VIP | $70,000 | 0.4 pips | 750+ |

| Exclusive | $100,000 | 0.2 pips | 1200+ |

Notably, the entry-level “Basic” account requires a minimum deposit of $200, which might seem attractive to novice traders seeking to enter the market with a smaller investment. However, the platform fails to provide clear information about the leverage options associated with each account, a crucial factor in determining the risk level of your trades.

The Illusion of Regulation

Winfxmarkets goes to great lengths to create a facade of legitimacy, prominently displaying a UK address on its website and even boldly claiming to be “highly regulated.” However, these assertions are nothing more than a smoke screen.

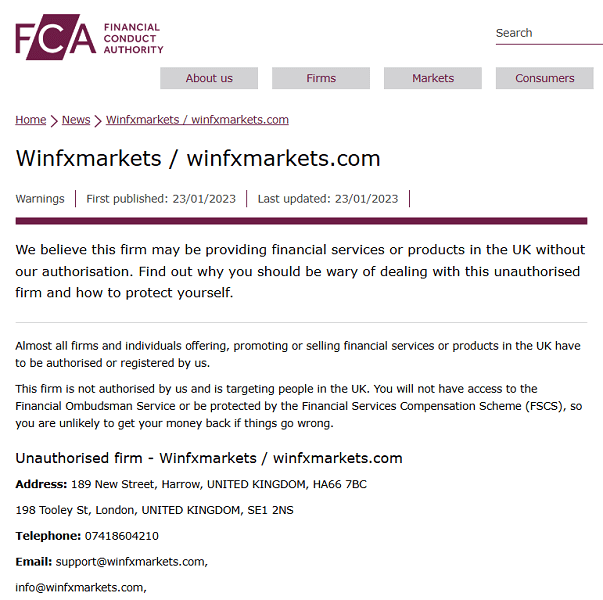

Upon closer inspection, it becomes clear that Winfxmarkets is operating without the authorization of the Financial Conduct Authority (FCA), the UK’s primary financial regulator. In fact, the FCA has explicitly issued a warning against Winfxmarkets, stating that the firm is “not authorized to provide financial services in the UK.”

The Perils of Trading with an Unregulated Broker

Choosing an unregulated broker like Winfxmarkets exposes your investments to significant risks. This lack of regulation is a major red flag for any potential investor. It means that Winfxmarkets is not subject to the stringent oversight and investor protection measures that legitimate brokers must adhere to. Your funds are not held in segregated accounts, as required by regulated entities, and you have no recourse to the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS) if things go wrong. Essentially, investing with Winfxmarkets is akin to gambling with your money, with no safety net in place if the platform collapses or engages in fraudulent activities.

Without the oversight of a reputable financial authority, your funds are not protected, and you have limited recourse if something goes wrong. This means:

- No Investor Protection: If Winfxmarkets were to become insolvent or disappear with your funds, you would likely have no legal avenue to recover your losses.

- Potential for Fraud: Unregulated brokers operate in a legal gray area, making them more susceptible to engaging in fraudulent activities such as manipulating prices, misrepresenting information, or simply running off with your money.

- Limited Recourse: If you have a dispute with Winfxmarkets, you cannot turn to a regulatory body for assistance. This leaves you with limited options for resolving any issues or complaints.

Victim to an Online Scam?

CNC Intelligence specializes in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation by filling out the form below.

Conclusion: Protecting Your Investments

Based on the evidence presented, Winfxmarkets appears to be an unregulated and potentially fraudulent broker. Investors should avoid this platform at all costs. Instead, choose a forex broker that is regulated by a reputable authority, such as the FCA, CySEC, or ASIC. These regulators provide essential investor protections and ensure that brokers adhere to strict standards of conduct.

Remember, your financial security is paramount. Don’t be lured by empty promises or flashy websites. Do your research, choose a regulated broker, and invest wisely.

FAQ

Winfxmarkets a regulated broker?

No, Winfxmarkets is not regulated by any reputable financial authority, including the FCA, despite claims of being a UK-based company.

What are the risks of trading with Winfxmarkets?

Investing with an unregulated broker like Winfxmarkets carries significant risks, including the potential loss of your entire investment due to fraud or insolvency.

Should I invest with Winfxmarkets?

Based on the numerous red flags and warnings, it is strongly advised to avoid Winfxmarkets and choose a regulated broker for your forex trading.