Table of Contents

| 🏢 Company Name: | 4Square SY Ltd |

| 🌐 Website: | capitalix.com |

| 📍 Supposed Address: | CT House, Office 9A, Providence, Mahe, Seychelles |

| 📞 Phone: | +97142491118 +541139857766 +56227120378 +50224581123 +525599900281 +5078355542 +5154375826 +918327121011 +551150265398 +815030923462 +41275087668 |

| ✉️ Email: | [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

Introduction

Intrigued by the world of online trading? Capitalix might pop up on your radar during your research. They offer a sleek platform boasting a variety of assets and account types. But before you dive in, let’s take a closer look at Capitalix and see if it measures up.

Company Background and Regulation

Capitalix is owned and operated by 4Square SY Ltd, a company registered in the Republic of Seychelles. It is licensed by the Financial Services Authority Seychelles under license number SD052.

It’s crucial to note that Seychelles’ regulations are generally considered less stringent compared to top-tier regulatory bodies like the UK’s FCA or Australia’s ASIC. This doesn’t necessarily mean Capitalix is illegitimate, but it’s a factor to consider for your financial security.

Features and Account Types

Capitalix dives into the world of online Contract for Difference (CFD) trading, allowing users to speculate on price movements of various financial instruments without directly owning them. Capitalix offers a diverse marketplace for you to explore. With over 350 tradable assets, you’ll find a comprehensive mix of popular instruments, including Forex pairs, Cryptocurrencies, Indices, Metals, Shares, and Commodities.

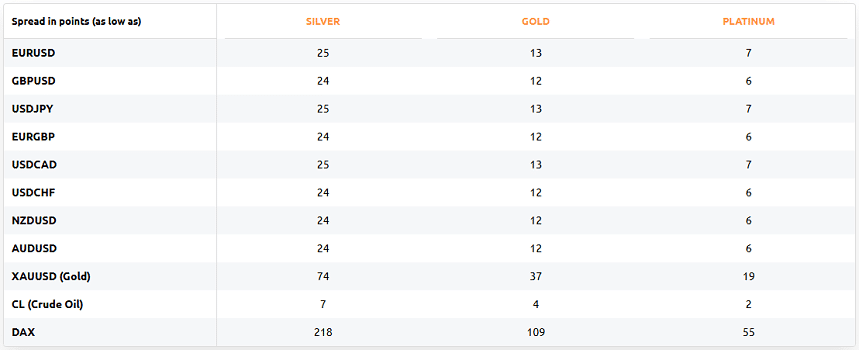

Three types of accounts are available (Silver, Gold, and Platinum), suitable for various experience levels with different spreads. The leverage on different assets remains the same for each type of account.

The minimum deposit to get started is $250, making it accessible to a broader range of potential traders. They also equip you with analytical tools and technical analysis indicators directly on their trading platform, empowering you to make informed decisions within your chosen market.

Cause for Alarm

Regulatory Warnings

Despite its appealing features, Capitalix has faced significant regulatory scrutiny. Several financial regulators have issued warnings against Capitalix, including:

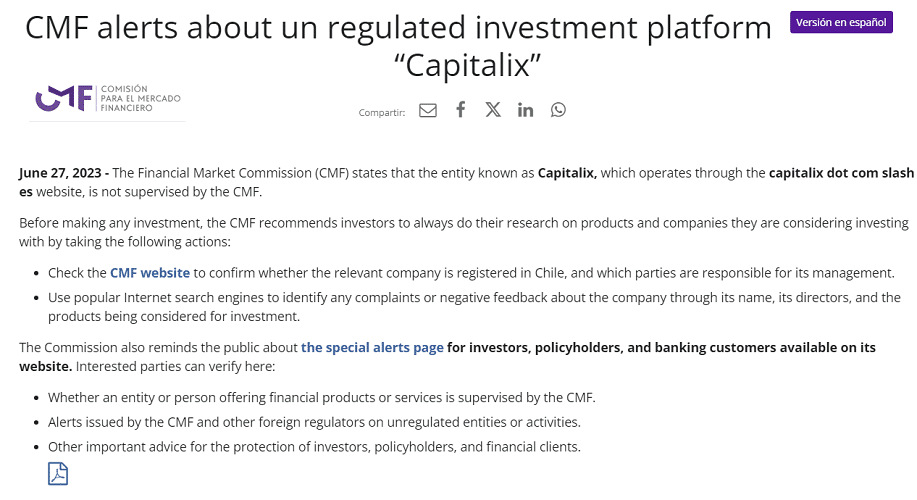

- June 27, 2023: The Financial Market Commission (CMF) in Chile: Advises that Capitalix is not authorized to provide financial services in Chile.

- August 21, 2023: The Superintendencia del Mercado de Valores (SMV) in Panama: Highlights that Capitalix lacks authorization to operate within Panama.

- March 22, 2024: The Financial Services Agency (FSA) in Japan: States that 4Square SY Ltd is not registered in Japan and should not be offering financial services.

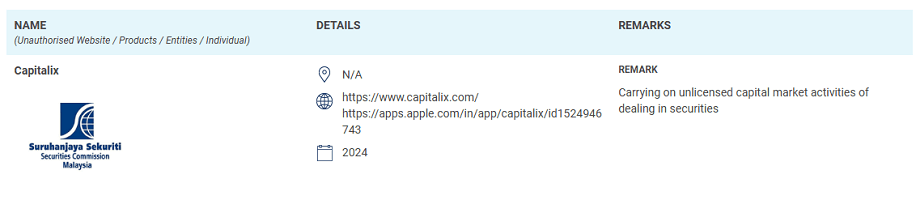

- May 2, 2024: The Securities Commission (SC) in Malaysia: Warns that Capitalix is not authorized to operate in Malaysia.

Consumer Feedback

Before entrusting your hard-earned money to any online trading platform, delving into user reviews is a crucial step. These reviews offer valuable insights from real people who have used the platform firsthand.

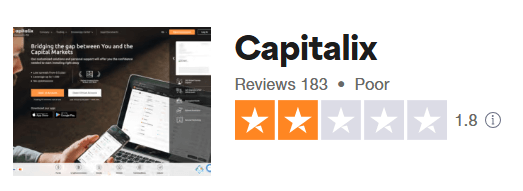

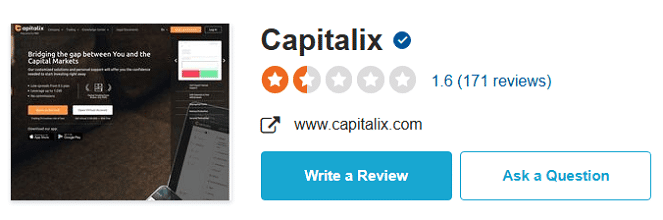

On platforms like Trustpilot and Sitejabber, you’ll find a mix of positive and negative experiences for Capitalix.com. While some users praise the platform’s user-friendliness and asset selection, a significant number of reviews raise concerning issues.

Several customers allege they were scammed by the company. It’s important to remember that not every negative review is definitively true, but the sheer volume of complaints regarding scams paints a concerning picture. These reviews highlight the importance of taking online feedback seriously.

While some negative experiences might be isolated incidents, a consistent pattern of complaints can be a red flag, indicating potential problems with the platform’s practices or customer service.

Conclusion

Capitalix offers a wide range of trading instruments and tools, making it an appealing option for traders seeking diversity. However, the offshore regulation and numerous regulatory warnings are significant red flags. Additionally, the negative consumer feedback further underscores the potential risks associated with using this platform.

FAQ

Is Capitalix regulated?

Yes, it is licensed by the Financial Services Authority Seychelles under license number SD052.

What types of accounts does Capitalix offer?

Capitalix offers three account types: Silver, Gold, and Platinum.

What is the minimum deposit for Capitalix?

The minimum deposit is $250.

Are there regulatory warnings against Capitalix?

Yes, regulators from Chile, Panama, Japan, and Malaysia have issued warnings.

Should I trust Capitalix?

Due to its offshore regulation, regulatory warnings, and numerous negative reviews, exercise caution.