Table of Contents

| 🏢 Company Name: | Dominion Markets LLC |

| 🌐 Website: | dominionmarkets.com |

| 📍 Supposed Address: | Bonovo Road – Fomboni Island of Mohéli – Comoros Union |

| 📞 Phone: | +(971) 4433 9924 |

| ✉️ Email: | [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

Introduction

Dominion Markets is an online trading platform offering access to a diverse range of financial instruments. While they emphasize low latency execution and high leverage as their key selling points, the offshore nature of their operations raises important questions about their reliability and the safety of client funds.

This comprehensive review delves into the intricacies of Dominion Markets, examining its trading accounts, platforms, asset offerings, deposit and withdrawal methods, regulatory standing, and overall reputation.

We aim to provide traders with the insights needed to make informed decisions about entrusting their investments to this broker.

Dominion Markets Regulation and Security

In the world of online trading, the regulatory landscape is a critical factor to consider when evaluating a broker’s trustworthiness and the safety of your funds. Let’s delve into the regulatory status of DominionMarkets and assess the potential implications for traders.

Regulatory Status

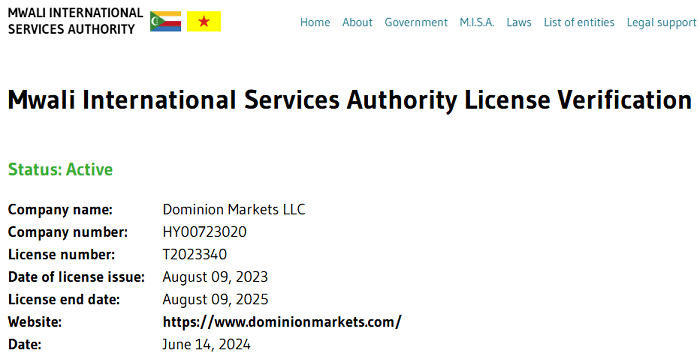

Dominion Markets is operated by Dominion Markets LLC, a company registered in the Comoros Islands and claims to be regulated by the Mwali International Services Authority (MISA) under license number T2023340. While this might give the impression of legitimacy, it’s important to understand the nuances of this regulatory framework.

The MISA, compared to more established regulatory bodies like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Commodity Futures Trading Commission (CFTC) in the US, is generally considered to have less stringent oversight and enforcement mechanisms. This means that the level of protection afforded to traders might be significantly lower compared to brokers regulated by top-tier authorities.

Furthermore, DominionMarkets claims to have an office in Dubai but fails to provide any evidence of licensing from the Dubai Financial Services Authority (DFSA), the regulatory body overseeing financial activities in the Dubai International Financial Centre. This discrepancy raises further questions about the broker’s transparency and adherence to regulatory standards. It is also important to mention that Dominion Markets does not accept clients from the US or Canada.

Risks Associated with Trading with a Weakly Regulated Broker

Opting to trade with a broker operating under a less stringent regulatory framework, like Dominion Markets, exposes traders to several potential risks:

- Limited Client Fund Protection: In the event of broker insolvency or misconduct, the level of protection for your funds might be significantly lower compared to brokers regulated by top-tier authorities. Compensation schemes or recourse options might be limited or non-existent.

- Lack of Transparency: Brokers regulated by less stringent authorities might not be subject to the same rigorous reporting and disclosure requirements as those under the purview of more established regulators. This can lead to a lack of transparency regarding the broker’s financial health, operational practices, and potential conflicts of interest.

- Potential for Unfair Practices: The absence of robust regulatory oversight can create an environment where brokers might engage in unfair practices, such as price manipulation, slippage, or unfavorable trading conditions, without facing significant consequences.

- Difficulty Resolving Disputes: In case of a dispute with a weakly regulated broker, your options for seeking resolution might be limited. The lack of a strong regulatory framework can hinder your ability to enforce your rights or obtain compensation.

Dominion Markets Trading Accounts and Conditions

Account Types: STP, ECN and Islamic

DominionMarkets.com provides a range of four account types tailored to different trading styles and experience levels. Here’s a breakdown of each:

- Standard STP: Ideal for beginners, this account offers commission-free trading with spreads starting from 2.0 pips. The minimum deposit is $50, and it caters to various trading styles.

- ECN: Designed for experienced traders seeking deep liquidity and tight spreads, this account features raw spreads from 0.0 pips, but a commission of $3.5 per lot per side applies. The minimum deposit for this account is $1000.

- ECN Pro: This account is targeted at professional traders and boasts institutional-grade liquidity with raw spreads from 0.0 pips. Like the ECN account, it involves a commission of $3.5 per lot per side, but the minimum deposit is significantly higher at $10,000.

- Islamic Account: This swap-free account caters to traders following Islamic principles. It offers spreads from 1.5 pips and includes commissions.

Demo Account: Practice Makes Perfect

For those new to trading or wanting to test strategies, Dominion Markets provides a demo account. This allows you to practice in a risk-free environment with virtual funds.

Trading Platform: cTrader

Dominion Markets has made a significant shift by transitioning away from the widely-used MetaTrader 4 and 5 platforms and adopting cTrader as its primary trading platform. This modern and feature-rich platform is gaining popularity among traders due to its:

- Advanced charting tools

- Customizable interface

- Support for algorithmic trading

- Availability on desktop, web, and mobile devices

While cTrader offers a robust and intuitive trading experience, traders accustomed to MetaTrader 4 or 5 might require a learning curve to adapt to its unique interface and features.

Tradable Assets: A Diverse Selection

DominionMarkets offers a range of over 200 tradable instruments:

- Forex: 55 currency pairs

- Cryptocurrencies: 35 pairs

- Stocks: 64 CFDs

- Indices: 11 major indices

- Metals & Commodities: Various options

This selection allows for diversification and caters to different trading strategies.

Leverage and Margin: High Leverage, High Risk

Dominion Markets offers leverage up to 1:500 for forex trading, providing the potential for significant gains but also amplifying losses. It’s important to note that leverage for indices, metals, cryptocurrency pairs, and stocks is capped at a more conservative 1:100.

Margin calls are triggered when your margin level falls to 100%, and stop-outs occur if your margin level falls to or below 80%. Traders should exercise caution and employ prudent risk management tools when utilizing high leverage, as it can significantly increase the potential for both profits and losses.

Deposit Methods

Dominion Markets provides the following deposit options:

- Cryptocurrencies: This is the primary and fastest method for depositing funds. The broker accepts a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), DASH, Bitcoin Cash (BCH), Monero (XMR), NEO, Ripple (XRP), and Cardano (ADA). The minimum deposit for crypto transactions is $50.

- Credit/Debit Card: Dominion Markets also accepts deposits via major credit and debit cards. The minimum deposit for card transactions is $100.

- Wire Transfer: This traditional method is available for larger deposits, but it typically involves longer processing times and potential bank fees. The minimum deposit for wire transfers is also $100.

Withdrawal Methods

DominionMarkets offers the following withdrawal options:

- Cryptocurrencies: The broker facilitates same-day crypto withdrawals, promising to process requests within 24 hours. Once processed, funds are sent directly to your designated crypto wallet.

- Credit/Debit Card and Bank Transfer: Withdrawals can also be made via credit/debit card or bank transfer. However, it’s important to note that if you initially deposited funds using crypto, you can only withdraw via crypto. The same restriction applies to bank transfers and card payments.

The minimum withdrawal amount for all methods is $50. While Dominion Markets aims to review withdrawal requests within 24 hours, the actual time it takes to receive your funds can vary depending on the chosen method and potential blockchain network congestion for crypto withdrawals.

Dominion Markets Customer Support

Dominion Markets offers a few primary channels for reaching their customer support team:

- Email: You can contact the support team via their official email address: [email protected].

- Phone: Direct phone support is available through their provided number: +(971) 4433 9924.

- Social Media: The broker maintains a presence on social media platforms, specifically Instagram, X (formerly Twitter), and YouTube. While these channels might not be the most efficient for resolving complex issues, they can be helpful for quick updates, general inquiries, or staying informed about the latest news and announcements from the broker.

Dominion Markets User Reviews and Reputation

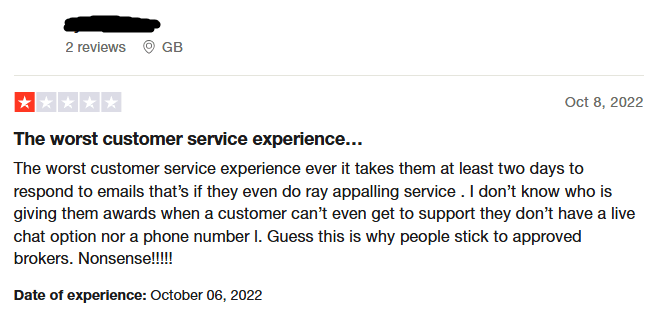

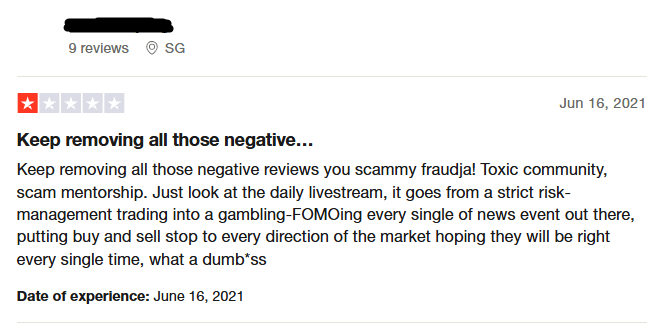

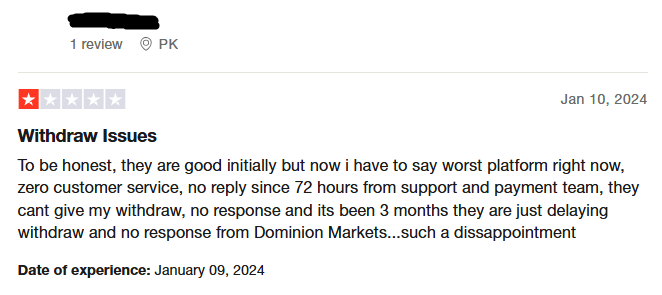

Dominion Markets’ Trustpilot page presents a mixed picture, with reviews starkly divided between 5-star praise and 1-star criticism. While Trustpilot has flagged and removed some fake reviews, the remaining feedback still shows a clear polarization.

As of now, there is 132 customers reviews. 34% of the reviews are 1-star, while 62% are 5-star, indicating a lack of middle-ground experiences.

Positive Reviews (5-star)

- Fast Execution and Low Latency: Several positive reviews commend Dominion Markets for its swift execution speeds and low latency, which can be particularly appealing to scalpers and high-frequency traders.

- Competitive Spreads: Users also appreciate the tight spreads offered by the broker, especially on the ECN accounts.

- Variety of Instruments: The availability of multiple asset classes, including cryptocurrencies, is seen as a positive by some traders.

- User-Friendly Platform: The cTrader platform receives praise for its intuitive interface and advanced charting tools.

Negative Reviews (1-star)

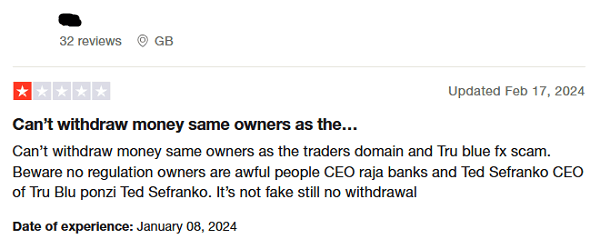

- Withdrawal Issues: The most prominent complaint revolves around difficulties in withdrawing funds. Users report experiencing delays, unresponsive customer support, and even accusations of the broker withholding funds.

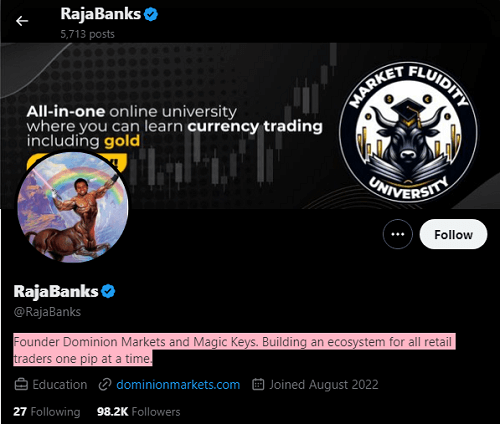

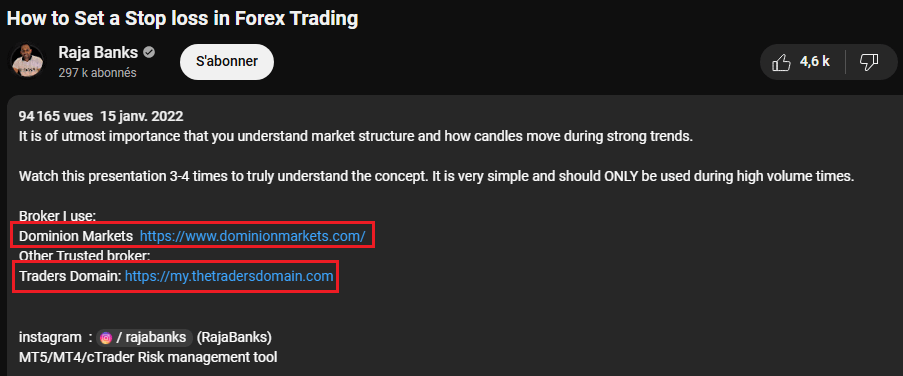

- Connection to Previous Scams: Several reviews draw a direct link between Dominion Markets and previous scam brokers like The Traders Domain and Trubluefx, alleging that the same individuals, including “Raja Banks” and “Ted Sefranko,” are behind these operations.

- Slow support and misleading information: User points out inconsistencies in the information provided by Dominion Markets’ support team, particularly regarding withdrawal times. The absence of live chat support and the lack of transparency are also highlighted as major drawbacks.

RajaBanks Connection: A Red Flag?

Further adding to the concerns surrounding DominionMarkets is the claim by RajaBanks, a Twitter and YouTube content creator, that he is the founder of the broker. This association raises alarm bells, as RajaBanks has previously promoted a scam forex broker (The Traders Domain review) that was shut down by the CFTC for operating a Ponzi scheme.

While it’s important to note that this connection doesn’t automatically imply that Dominion Markets is also a scam, it certainly warrants additional scrutiny and caution from potential traders.

Conclusion

Dominion Markets presents a challenging proposition for traders. While its low-latency execution, diverse asset selection, and high leverage might be alluring, its offshore status and concerning user feedback create a significant dilemma.

The absence of robust regulatory oversight raises legitimate concerns about the safety of client funds and the potential for unfair practices. The numerous negative reviews on Trustpilot, highlighting withdrawal difficulties and unresponsive customer support, further underscore these risks.

Ultimately, prioritizing regulation and security when choosing a forex broker is paramount. If you’re seeking a safe and transparent trading environment, exploring regulated alternatives with a proven track record might be a more prudent choice.

Remember, forex trading involves substantial risk, and responsible trading practices are essential. Choose your broker wisely, invest only what you can afford to lose, and prioritize the security of your funds.

Disclaimer: This review is based on information publicly available at the time of writing. The forex market is dynamic, and brokers’ offerings and conditions can change. It’s always advisable to conduct your own research and due diligence before making any investment decisions.

FAQ

Is Dominion Markets a regulated broker?

Dominion Markets is licensed by the Mwali International Services Authority (MISA) in Comoros, but this regulation is considered weak compared to top-tier authorities like the FCA or ASIC.

What account types does Dominion Markets offer?

Dominion Markets offers, Demo, Standard STP, ECN, ECN Pro, and Islamic accounts, each with varying features and minimum deposits.

What trading platform does Dominion Markets use?

Dominion Markets has transitioned to the cTrader platform, known for its advanced charting and algorithmic trading capabilities.

What assets can I trade with Dominion Markets?

You can trade a variety of assets, including Forex, Cryptocurrencies, Indices, Metals, Stocks and Commodities

What is the maximum leverage offered by Dominion Markets?

Dominion Markets offers leverage up to 1:500 for Forex and 1:100 for other instruments.

What are the deposit and withdrawal methods available?

Dominion Markets supports deposits via cryptocurrencies, credit/debit cards, and wire transfers. Withdrawals can be made via the same methods used for deposits.

Are there any concerns about withdrawals with Dominion Markets?

Yes, numerous user reviews on Trustpilot highlight difficulties and delays in withdrawing funds.

Is Dominion Markets available for US and Canadian citizens?

No, Dominion Markets does not accept clients from the USA or Canada.