Table of Contents

| 🏢 Company Name: | DUTTFX MARKETS LTD |

| 🌐 Website: | duttfxmarkets.net |

| 📍 Supposed Address: | Bonovo Road - Fomboni, Island of Moheli, Comoros Union / Office 210,Al Nasr Plaza-COMM, OUD Metha, Dubai, UAE |

| 📞 Phone: | - |

| ✉️ Email: | [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

DUTTFX Markets – An Offshore Broker with Limited Oversight

DUTTFX Markets (duttfxmarkets.net) presents itself as an online trading platform offering a range of financial instruments, including forex, cryptocurrencies, stocks and commodities. While the allure of offshore brokers can be tempting, with potential benefits like higher leverage and looser regulations, it’s crucial to tread cautiously.

This review of DUTTFX Markets will shed light on its offerings, regulatory status, and potential risks, helping you make an informed decision about whether to invest your money.

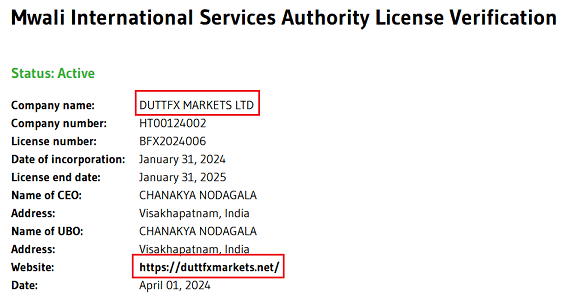

M.I.S.A. Regulated Broker

DUTTFX Markets operates under the regulatory oversight of the M.I.S.A. (Mwali International Services Authority) with license number: BFX2024006. While this may provide some level of oversight, it’s important to note that offshore regulators like the M.I.S.A. are generally considered less stringent than those in major financial hubs like the FCA (UK) or the ASIC (Australia).

This means that investor protections and recourse options may be limited compared to trading with a broker regulated by a top-tier authority.

Trading Platform and Account Types

DUTTFX Markets offers the popular MetaTrader 5 (MT5) platform, renowned for its user-friendly interface, advanced charting tools, and automated trading capabilities. The platform supports a variety of trading instruments, including forex, cryptocurrencies, and commodities, allowing for a diversified trading experience.

Account Options:

DUTTFX Markets offers three account types, each with distinct features and minimum deposit requirements:

- Standard Account

- Minimum Deposit: $1000

- Spread: From 1.8 pips

- Leverage: Up to 1:200

- Premium Account

- Minimum Deposit: $5000

- Spread: From 1.2 pips

- Leverage: Up to 1:400

- ECN Account

- Minimum Deposit: $50,000

- Spread: 0

- Commission: $5

- Leverage: Up to 1:400

Funding and Withdrawals:

DUTTFX Markets offers several deposit and withdrawal methods, including credit/debit cards, Neteller, Skrill, bank transfers, and FasaPay. However, it’s important to be aware that withdrawal processing times and fees may vary depending on the chosen method.

Some online sources suggest that users have experienced delays and difficulties with withdrawals, a red flag that potential traders should consider carefully. It’s always advisable to test a platform’s withdrawal process with a small amount before committing significant funds.

Conclusion: Tread Carefully with DUTTFX Markets

DUTTFX Markets is an offshore broker, While the platform may offer attractive features and a user-friendly interface, the lack of robust regulatory oversight and reports of withdrawal issues warrant caution. If you’re considering trading with DUTTFX Markets, conducting thorough research, verifying the platform’s claims, and understanding the risks involved is crucial.

FAQ

Is DUTTFX Markets a regulated broker?

Yes, technically DUTTFX Markets is regulated by the M.I.S.A. of Mwali, Comoros Union. However, this is an offshore jurisdiction with weaker regulatory oversight compared to major financial regulators like the FCA, ASIC or BaFin.

What trading platform does DUTTFX Markets offer?

DUTTFX Markets provides the MetaTrader 5 (MT5) platform.

What are the account types available on DUTTFX Markets?

DUTTFX Markets offers three account types: Standard, Premium, and ECN, each with different minimum deposits, spreads, and leverage options.

What are the risks of trading with DUTTFX Markets?

Investing with an offshore broker like DUTTFX Markets carries inherent risks, including the potential loss of your entire investment due to lack of investor protection and the possibility of fraudulent activity.

Should I invest with DUTTFX Markets?

Given the lack of strong regulation, potential risks, and concerns about withdrawal issues, it’s highly recommended to exercise caution and consider alternative, regulated brokers.