Table of Contents

| 🏢 Company Name: | Osprey Ltd |

| 🌐 Website: | ospreyfx.com |

| 📍 Supposed Address: | Beachmont Business Centre, Suite 4, Kingstown, St Vincent and the Grenadines, K001 |

| 📞 Phone: | - |

| ✉️ Email: | [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

Introduction

Established in 2019 and headquartered in St. Vincent and the Grenadines, OspreyFX serves as a gateway to various financial markets. Traders can access forex, stocks, commodities, indices, and cryptocurrencies through its ECN account type, offering direct market access and potentially tighter spreads.

This review aims to explore the offerings of OspreyFX, highlighting its strengths and weaknesses, and ultimately helping you decide if it’s the right fit for your trading journey.

OspreyFX Trading Accounts and Conditions

OspreyFX is an ECN broker, which means that it offers direct access to the market. This can be beneficial for traders who want to avoid the dealing desk and get the best possible prices.

ECN accounts typically have lower spreads than standard accounts. This is because ECN brokers do not take a spread themselves; they simply connect buyers and sellers directly. OspreyFX ECN account details are as follows:

| Execution Type | Market Execution |

| Trading Model | ECN STP |

| Max Leverage | 1:500 |

| Min. Trade Size | 0.01 |

| Max. Trade Size | 1000 lots |

| Available Instruments | Forex, Indices, Commodities, Cryptos, Metals, Stocks |

| Trading Platforms | TradeLocker |

| Swaps | Yes |

| Margin Call | 100% |

| Stop Out Level | 70% |

OspreyFX’s ECN account provides four unique methods for trading forex, each featuring varying spread levels, minimum deposits, and commissions per lot.

| Account Type | Minimum Deposit | Spread | Commission Per Lot | Forex Pairs |

|---|---|---|---|---|

| Mini | $25 | From 1.0 | $1.00 | 29 |

| Standard | $50 | From 0.8 | $7.00 | 55 |

| VAR | $250 | From 1.2 | $0.00 | 55 |

| PRO | $500 | From 0.4 | $8.00 | 55 |

Overall, OspreyFX’s ECN account is a good option for traders who want to get the best possible prices and have access to a wide range of features.

For those new to forex trading or wanting to test strategies risk-free, OspreyFX offers a demo account. This allows you to practice trading with virtual funds in a simulated market environment, gaining valuable experience without any financial commitment.

Trading Platform

OspreyFX recently transitioned from MT4 to TradeLocker platform. This platform praise a user-friendly interface, advanced charting tools, and a suite of technical indicators. It’s available on desktop, web, and mobile devices (iOS and Android), ensuring you can trade on the go. However, some users might miss the familiarity and extensive customizability of MT4.

Asset Diversity

OspreyFX offers a respectable selection of over 120 tradable instruments across various asset classes:

- Forex: FX Major, FX Crosses, and exotic currency pairs

- Crypto: Popular cryptocurrencies is available on OspreyFX like Bitcoin, Ethereum, Litecoin, Binance Coin, Solana and Polkadot.

- Metals: Gold, Silver, Copper

- Indices: Major global stock indices like Dow Jones 30, S&P 500, NASDAQ 100, CAC 40.

- Commodities: Precious metals, energies, and agricultural commodities

While this selection appeals to diverse trading strategies, it might not be as extensive as some other brokers offering thousands of instruments.

Leverage and Margin

OspreyFX offers leverage up to 1:500, allowing you to control larger positions with a smaller capital outlay. While this can magnify profits, it also amplifies losses. It’s crucial to exercise caution and employ risk management strategies when using high leverage.

OspreyFX Deposits and Withdrawals

OspreyFX offers a variety of deposit and withdrawal methods to accommodate the needs of its global clientele. Let’s explore the options and any potential concerns:

Deposit Methods

- Credit/Debit Card: A convenient option for most traders, allowing instant deposits with major card providers (VISA, Mastercard).

- Skrill: A popular e-wallet offering secure and fast transactions.

- AstroPay: A prepaid card solution widely used in emerging markets.

- Sofort: A direct bank transfer method popular in Europe.

- PostePay: An Italian prepaid card option.

- Cryptocurrencies: OspreyFX accepts deposits in various cryptocurrencies, providing an alternative for those who prefer digital assets.

The minimum and maximum deposit amounts vary depending on the chosen method. While most deposits are processed instantly, some methods, like bank transfers, might take a few business days. OspreyFX does not charge any deposit fees, but your payment provider might apply their own charges.

Withdrawal Methods

- Credit/Debit Card: Withdrawals to the original card used for deposit are usually processed within 3-5 business days.

- Wire/Bank Transfer: As the most widely used money transfer method globally, wire transfers allow you to move funds directly from your OspreyFX Wallet to your bank account. While OspreyFX aims to process these within one business day, the transfer itself can take up to 6 days to complete. Note that a $25 banking fee applies to withdrawals up to $5,000.

- Cryptocurrencies: Withdrawals in cryptocurrencies are generally faster than bank transfers but can be subject to network congestion and fees.

OspreyFX Regulation and Security

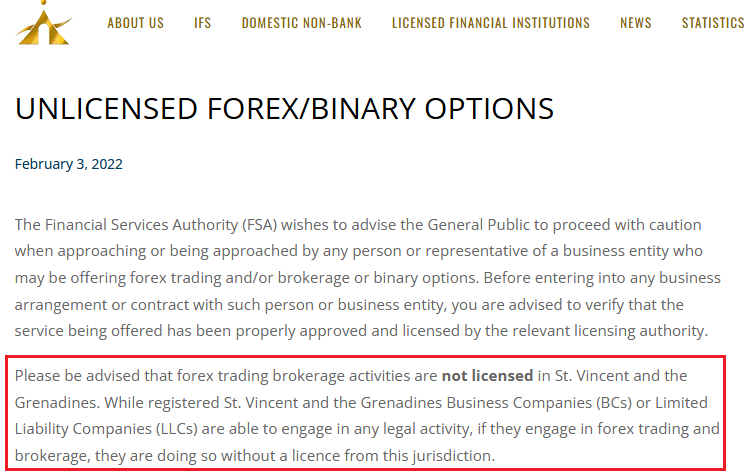

In the world of forex trading, regulation serves as a crucial safeguard, ensuring brokers adhere to strict standards of conduct and financial stability. Unfortunately, OspreyFX falls short in this critical aspect.

Regulatory Status

OspreyFX is not regulated by any major financial authority. This means that there’s no external oversight to ensure the broker’s operations are fair, transparent, or financially sound. The lack of regulation raises significant concerns about the safety of client funds and the overall reliability of the broker.

Adding to the concern, the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, where OspreyFX is based, has explicitly stated that forex trading activities are not regulated within their territory.

Risks of Trading with an Unregulated Broker

Trading with an unregulated broker like OspreyFX exposes you to several risks:

- No Protection of Client Funds: In the event of broker insolvency or misconduct, your funds may not be protected. There’s no guarantee of compensation or recourse.

- Lack of Transparency: Unregulated brokers may not be obligated to disclose crucial information about their operations, financial health, or conflict of interest policies.

- Potential for Fraudulent Activity: Without regulatory oversight, there’s a higher risk of encountering fraudulent practices, such as price manipulation or unfair trading conditions.

- Difficulty Resolving Disputes: If a dispute arises with an unregulated broker, you may have limited options for seeking resolution.

Client Fund Security

OspreyFX claims to take measures to protect client funds, such as segregating them from the company’s operational funds. However, without regulatory oversight, there’s no independent verification of these claims. The lack of a regulatory safety net leaves traders vulnerable in case of unforeseen events.

OspreyFX Customer Support

Reliable customer support can make a significant difference, especially when encountering technical issues or needing urgent assistance. OspreyFX claims to offer 24/7 customer support throughout the trading week. Let’s evaluate the customer support offered by OspreyFX:

Availability and Contact Methods

OspreyFX offers the following channels for reaching their customer support team:

- Submitting a Ticket: The primary method for contacting support involves submitting a ticket through their website. While this might not offer the immediacy of live chat, it ensures your query is logged and addressed in due course.

- Email: For less urgent matters or detailed explanations, you can also reach out to them via email.

- Social Media: OspreyFX maintains a presence on various social media platforms, including Instagram, Facebook, X (formerly Twitter), Discord, and Telegram. While these channels might not be ideal for resolving complex issues, they can offer quick updates and general assistance.

OspreyFX User Reviews and Reputation

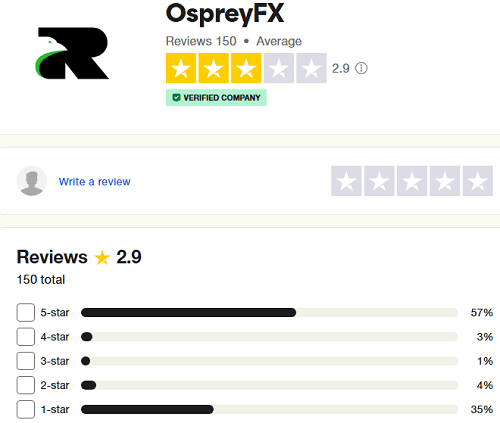

OspreyFX’s Trustpilot page paints a starkly contrasting picture, with a significant divide between glowing 5-star reviews and scathing 1-star critiques. As of now, the platform displays an average rating of 2.9 stars based on 150 reviews, highlighting the polarized nature of user experiences.

The polarized nature of the Trustpilot reviews suggests that user experiences with OspreyFX are far from uniform. While some traders seem to enjoy favorable trading conditions and efficient support, others encounter significant challenges, primarily related to withdrawals and the lack of regulation.

It’s essential to approach these reviews with a healthy dose of skepticism and consider them alongside other sources of information before forming a definitive opinion.

Conclusion

In conclusion, OspreyFX presents a mixed bag for forex traders. While it offers certain advantages like competitive spreads, high leverage, and a user-friendly platform, its unregulated status and potential withdrawal issues cast a significant shadow over its appeal.

Ultimately, the decision rests with you. If you prioritize regulation and security, opting for a reputable, regulated broker is the wisest course of action. If you’re willing to accept the risks associated with an unregulated broker, OspreyFX might be an option, but proceed with caution and thorough due diligence.

Remember, forex trading involves significant risk, and it’s essential to trade responsibly and only invest capital you can afford to lose.

FAQ

Is OspreyFX a regulated broker?

No, OspreyFX is not regulated by any major financial authority. This means there’s no external oversight to ensure its operations are fair and transparent.

What trading platforms does OspreyFX offer?

OspreyFX uses the TradeLocker platform, accessible on desktop, web, and mobile devices (iOS and Android).

What account types does OspreyFX offer?

OspreyFX primarily offers an ECN account for direct market access and tighter spreads. They also provide a demo account for traders to practice risk-free with virtual funds.

What is the maximum leverage offered by OspreyFX?

OspreyFX provides leverage up to 1:500, though it’s crucial to use leverage cautiously due to the amplified risk of losses.

What assets can I trade with OspreyFX?

OspreyFX offers a selection of over 120 tradable instruments, including forex, cryptocurrencies, metals, indices, and commodities.

What deposit and withdrawal methods are available?

OspreyFX supports various deposit and withdrawal methods, including credit/debit cards, e-wallets like Skrill, bank transfers, and cryptocurrencies.

What are the potential risks of trading with OspreyFX?

The primary risk stems from its unregulated status, which means your funds may not be protected in case of broker insolvency or misconduct.