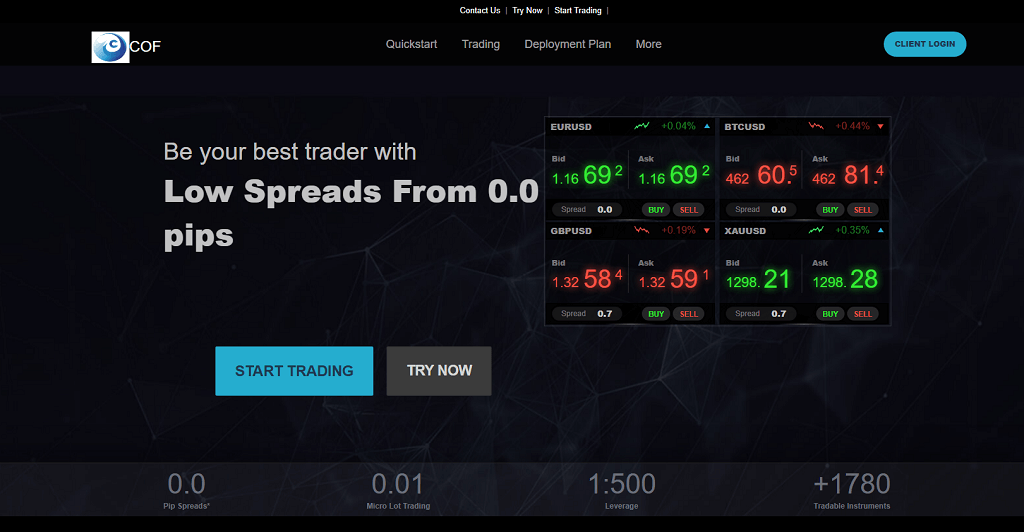

| 🏢 Company Name: | COF Globol |

| 🌐 Website: | cofglobol.com |

| 📍 Supposed Address: | - |

| 📞 Phone: | - |

| ✉️ Email: | [email protected] |

Is COF Globol Legit?

COF Globol has recently raised red flags due to warnings issued by reputable financial regulators. This in-depth review will explore the potential risks, the specific warnings issued, and additional red flags that investors should be aware of.

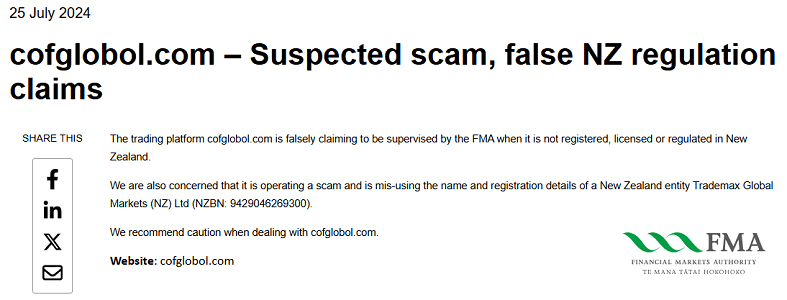

A Major Red Flag for COF Globol

The Financial Markets Authority (FMA) and The Financial Services Authority Seychelles (FSA), has issued a warning against COF Globol, stating that it is not authorized or licensed to offer financial services in their respective jurisdictions. This warning raises serious concerns about the platform’s legitimacy and indicates that it may be operating as an unauthorized financial entity.

Should You Invest with COF Globol?

Investing with a company that has received warnings from financial regulators, like COF Globol, is highly risky. These warnings often indicate that the company is operating without proper authorization or engaging in questionable practices.

In most cases, these companies are unregulated, meaning your investments are not protected, and you could lose your money if the company faces financial difficulties or engages in fraudulent activities. It’s crucial to prioritize your financial security and choose a regulated platform.

Protecting Yourself from COF Globol

If you’re considering investing with COF Globol, or any other financial platform, prioritize your financial security by following these essential steps:

- Verify Regulatory Status: Always check if the platform is licensed and regulated by a reputable financial authority in your jurisdiction. Unregulated platforms operate outside legal frameworks, leaving you vulnerable to potential scam and without recourse for complaints.

- Research Thoroughly: Investigate COF Globol company background, ownership, and history. Look for user reviews and news articles to get a comprehensive picture of their reputation and track record.

- Be Skeptical of Promises: Don’t be fooled by unrealistic promises of high returns or guaranteed profits. If it sounds too good to be true, it probably is.

- Start Small and Test Withdrawals: If you choose to invest, start with a small amount and test the platform’s withdrawal process first. This helps you check their reliability and avoid issues accessing your money later.

How the Scam Operates: Deceptive Tactics and Broken Promises

Various strategies are frequently used by fraudulent investment platforms to entice victims and increase their unjustified profits. Usually, these strategies typically involve:

- Aggressive Sales Tactics: Scam platforms often use high-pressure sales tactics to push potential investors into making quick decisions. This can include persistent phone calls, emails, and promises of unrealistically high returns.

- Withdrawal Challenges: After making a deposit, an investor may run into a number of challenges while trying to take their money out. These obstacles can include delays, excessive fees, unexplained account restrictions.

- Bait-and-Switch: To gain users’ trust, some platforms may allow initial withdrawals or even display fictitious gains. However, once the investor tries to withdraw a greater amounts or refuses to deposit more money, their account may be frozen, making it impossible to access their funds.

- False Promises: Scam platforms often make audacious claims about their technology, expertise, and guaranteed profits. These promises are designed to create a false sense of security and persuade victims to invest more money.

- Misleading Information: In order to look trustworthy, scammers may give incorrect or misleading information regarding their location, regulatory status, or investing methods.

It’s important to be aware of these tactics and to approach any online investment platform with caution. Always verify a company’s regulatory status, research its background, and read independent reviews before investing your money.

Victim to an Online Scam?

CNC Intelligence specializes in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation by filling out the form below.

Proceed with Caution Regarding COF Globol

Given the regulatory warnings and numerous red flags, it’s strongly advised to exercise extreme caution when dealing with COF Globol. The available information raises serious concerns about the legitimacy of this platform. Always prioritize your financial security and choose a reputable, licensed company that operates under regulatory oversight.

FAQ

Is COF Globol a regulated broker?

No, COF Globol is not regulated by any reputable financial authority

Has COFGlobol been flagged by any financial regulators?

The FMA and FSA Seychelles has issued a warning against COFGlobol.

What are the potential risks of investing with COF Globol?

Investing with an unregulated platform like COF Globol carries significant risks, including the potential loss of your entire investment due to fraud or insolvency.

Should I invest with COF Globol?

Given the lack of regulatory information and potential risks, it’s strongly recommended to exercise extreme caution before investing with COFGlobol.