| 🏢 Company Name: | CT Markets (UK) Ltd |

| 🌐 Website: | coinfrex.com |

| 📍 Supposed Address: | Cayman Islands |

| 📞 Phone: | +17072161510 |

| ✉️ Email: | [email protected] |

Introduction: Coinfrex’s Deceptive Web of Lies

Coinfrex (coinfrex.com) lures unsuspecting victims with the promise of easy cryptocurrency trading profits. However, this platform is not what it seems. In reality, Coinfrex is part of a network of fraudulent websites designed to deceive and exploit investors.

This in-depth review will expose the web of lies spun by Coinfrex and reveal the dangers lurking beneath its seemingly legitimate facade.

The Multi-Website Scam: Coinfrex’s Many Faces

Coinfrex is not an isolated incident. It appears to be part of a sophisticated scheme involving multiple websites that use false credentials to deceive investors. These websites often claim affiliation with regulated companies to create a false sense of security and trust. However, upon closer inspection, these claims quickly unravel, revealing a pattern of deception and fraudulent activity.

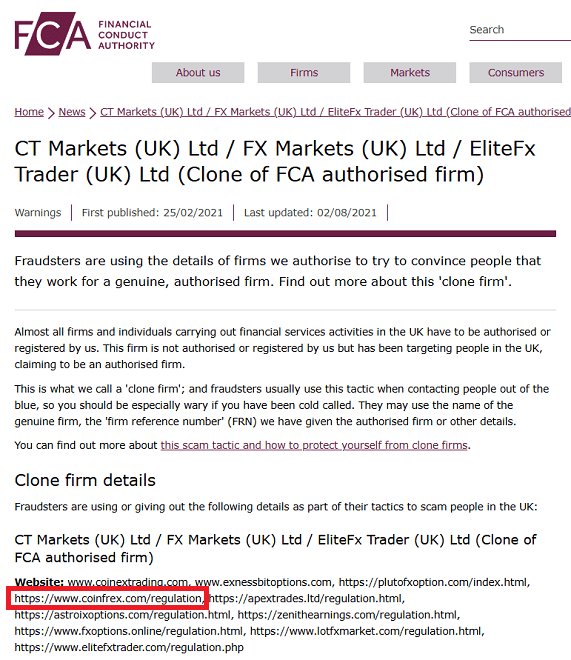

FCA Warning: Clone of a Regulated Firm

The Financial Conduct Authority (FCA), the UK’s financial regulator, has issued a warning against Coinfrex and other related websites, identifying them as clones of regulated firms. This means that Coinfrex (CT Markets (UK) Ltd) is fraudulently using the details of legitimate companies, such as HF Markets (UK) Limited, to lure in unsuspecting victims. The FCA has identified the following websites as part of this scam network:

- coinextrading.com

- exnessbitoptions.com

- plutofxoption.com

- coinfrex.com

- apextrades.ltd

- astroixoptions.com

- zenithearnings.com

- fxoptions.online

- lotfxmarket.com

- elitefxtrader.com

This extensive list of clone websites, which are likely replaced by new ones as regulatory warnings are issued, highlights the scale and sophistication of this ongoing fraudulent operation.

Lack of Regulation and Transparency

Like its sister sites, Coinfrex operates without any legitimate regulatory oversight. Despite falsely claiming to be regulated by the Cayman Islands Monetary Authority (CIMA), there is no evidence to support this assertion. This lack of regulation means that your investments are not protected, and you have no recourse if the platform collapses or disappears with your funds.

How the Scam Operates: Deceptive Tactics and Broken Promises

Various strategies are frequently used by fraudulent investment platforms to entice victims and increase their unjustified profits. Usually, these strategies typically involve:

- Aggressive Sales Tactics: Scam platforms often use high-pressure sales tactics to push potential investors into making quick decisions. This can include persistent phone calls, emails, and promises of unrealistically high returns.

- Withdrawal Challenges: After making a deposit, an investor may run into a number of challenges while trying to take their money out. These obstacles can include delays, excessive fees, unexplained account restrictions.

- Bait-and-Switch: To gain users’ trust, some platforms may allow initial withdrawals or even display fictitious gains. However, once the investor tries to withdraw a greater amounts or refuses to deposit more money, their account may be frozen, making it impossible to access their funds.

- False Promises: Scam platforms often make audacious claims about their technology, expertise, and guaranteed profits. These promises are designed to create a false sense of security and persuade victims to invest more money.

- Misleading Information: In order to look trustworthy, scammers may give incorrect or misleading information regarding their location, regulatory status, or investing methods.

It’s important to be aware of these tactics and to approach any online investment platform with caution. Always verify a company’s regulatory status, research its background, and read independent reviews before investing your money.

Victim to an Online Scam?

CNC Intelligence specializes in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation by filling out the form below.

Conclusion: Protecting Your Investments from Coinfrex

The evidence suggests that Coinfrex is part of a sophisticated scam network targeting unsuspecting investors. Its false claims of regulation, affiliation with legitimate companies, and the numerous red flags associated with its operations should serve as a clear warning.

It’s crucial to avoid Coinfrex and any other websites linked to this scam network. Choose reputable, regulated cryptocurrency exchanges or trading platforms to protect your investments and ensure a safe and transparent trading experience.

FAQ

Is Coinfrex regulated?

No, Coinfrex is not regulated by any financial authority despite false claims of being licensed.

Which regulatory bodies have warned against Coinfrex?

The UK’s Financial Conduct Authority (FCA) has issued a warning against Coinfrex as a clone of a regulated firm.

Is Coinfrex connected to other scam websites?

Yes, the FCA has identified multiple websites linked to Coinfrex as part of a larger fraudulent network.

What are the risks of trading with Coinfrex?

Investing with Coinfrex carries significant risks, including the potential loss of your entire investment due to fraud, manipulation, or lack of regulation.

Should I trust Coinfrex?

No, based on the evidence presented, Coinfrex appears to be a scam.