Table of Contents

| 🏢 Company Name: | Delta-Trend |

| 🌐 Website: | delta-trend.com |

| 📍 Supposed Address: | Uraniastrasse 31, 8001 Zürich, Switzerland |

| 📞 Phone: | +41215087359 +31858881793 +3185888178 |

| ✉️ Email: | [email protected] |

Got scammed by an online company? CNC Intelligence specializes in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation by filling out the form below.

Is Delta-Trend Legit?

Delta-Trend has recently raised red flags due to warnings issued by reputable financial regulators. This review will explore the potential risks, the specific warnings issued, and additional red flags that investors should be aware of.

A Major Red Flag for Delta-Trend

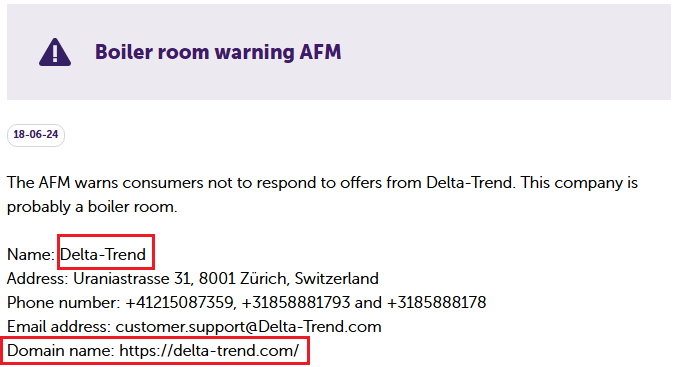

The following financial regulators have issued alerts against Delta-Trend, indicating it operates without the necessary authorization to offer financial services:

- The Comisión Nacional del Mercado de Valores (CNMV): Has issued a warning against Delta-Trend.

- The Netherlands Authority for the Financial Markets (AFM): Warns consumers not to respond to offers from Delta-Trend

These warnings raise serious concerns about the platform’s regulation status and suggest it may be operating as an unauthorized financial entity.

Investor Alert: The Red Flags You Need to Know About Delta-Trend

During our investigation of Delta-Trend, we noticed several red flags. We consider this platform to be dangerous and highly risky.

- Anonymous Website: There is no available information about the company or its legal status.

- No Regulation: Delta-Trend is not regulated by any financial authority.

- False Claims: The company claims to be located in the Switzerland but is not licensed by the Swiss Financial Market Supervisory Authority (FINMA). Additionally, Delta-Trend.com falsely claims to be regulated by the CySEC and FSCA.

- Negative User Reviews: Online user reviews highlight several warning signs, suggesting potential scams.

The opacity surrounding Delta-Trend operations and regulatory status makes it a highly suspicious platform, and investors should be wary of engaging with them.

Should You Invest with Delta-Trend?

Investing with a company that has received warnings from financial regulators, like Delta-Trend, is highly risky. These warnings often indicate that the company is operating without proper authorization or engaging in questionable practices.

In most cases, these companies are unregulated, meaning your investments are not protected, and you could lose your money if the company faces financial difficulties or engages in fraudulent activities. It’s crucial to prioritize your financial security and choose a regulated platform.

Protecting Yourself from Delta-Trend

If you’re considering investing with Delta-Trend, or any other financial platform, prioritize your financial security by following these essential steps:

- Verify Regulatory Status: Always check if the platform is licensed and regulated by a reputable financial authority in your jurisdiction. Unregulated platforms operate outside legal frameworks, leaving you vulnerable to potential scam and without recourse for complaints.

- Research Thoroughly: Investigate Delta-Trend company background, ownership, and history. Look for user reviews and news articles to get a comprehensive picture of their reputation and track record.

- Be Skeptical of Promises: Don’t be fooled by unrealistic promises of high returns or guaranteed profits. If it sounds too good to be true, it probably is.

- Start Small and Test Withdrawals: If you choose to invest, start with a small amount and test the platform’s withdrawal process first. This helps you check their reliability and avoid issues accessing your money later.

How the Scam Operates: Deceptive Tactics and Broken Promises

Various strategies are frequently used by fraudulent investment platforms to entice victims and increase their unjustified profits. Usually, these strategies typically involve:

- Aggressive Sales Tactics: Scam platforms often use high-pressure sales tactics to push potential investors into making quick decisions. This can include persistent phone calls, emails, and promises of unrealistically high returns.

- Withdrawal Challenges: After making a deposit, an investor may run into a number of challenges while trying to take their money out. These obstacles can include delays, excessive fees, unexplained account restrictions.

- Bait-and-Switch: To gain users’ trust, some platforms may allow initial withdrawals or even display fictitious gains. However, once the investor tries to withdraw a greater amounts or refuses to deposit more money, their account may be frozen, making it impossible to access their funds.

- False Promises: Scam platforms often make audacious claims about their technology, expertise, and guaranteed profits. These promises are designed to create a false sense of security and persuade victims to invest more money.

- Misleading Information: In order to look trustworthy, scammers may give incorrect or misleading information regarding their location, regulatory status, or investing methods.

It’s important to be aware of these tactics and to approach any online investment platform with caution. Always verify a company’s regulatory status, research its background, and read independent reviews before investing your money.

Proceed with Caution Regarding Delta-Trend

Given the regulatory warnings and numerous red flags, it’s strongly advised to exercise extreme caution when dealing with Delta-Trend. The available information raises serious concerns about the legitimacy of this platform. Always prioritize your financial security and choose a reputable, licensed company that operates under regulatory oversight.