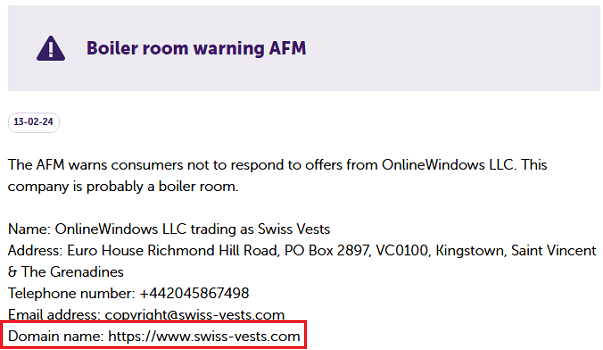

| 🏢 Company Name: | OnlineWindows LLC |

| 🌐 Website: | swiss-vests.com |

| 📍 Supposed Address: | Euro House Richmond Hill Road, PO Box 2897, VC0100, Kingstown, Saint Vincent and the Grenadines |

| 📞 Phone: | +442045867498 |

| ✉️ Email: | [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

Introduction

Swiss Vests presents itself as a global Forex and CFD brokerage, offering access to over 300 trading instruments across various markets. They promote their own web-based trading platform and guarantee a smooth trading experience. However, it is essential to address regulation and the assurances Swiss Vests provides to customers regarding safety.

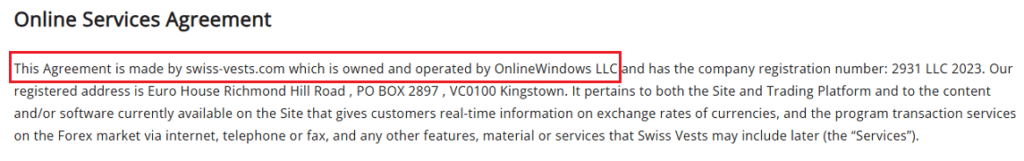

Ownership and Regulatory: Offshore Base

Swiss-Vests.com is operated by OnlineWindows LLC, a company registered in Saint Vincent and the Grenadines (SVG), a well-known offshore jurisdiction with lax financial regulations. While this in itself raises concerns, the platform further muddies the waters by claiming to be authorized to onboard traders “throughout various jurisdictions in the world,” without providing any evidence of actual regulatory licenses.

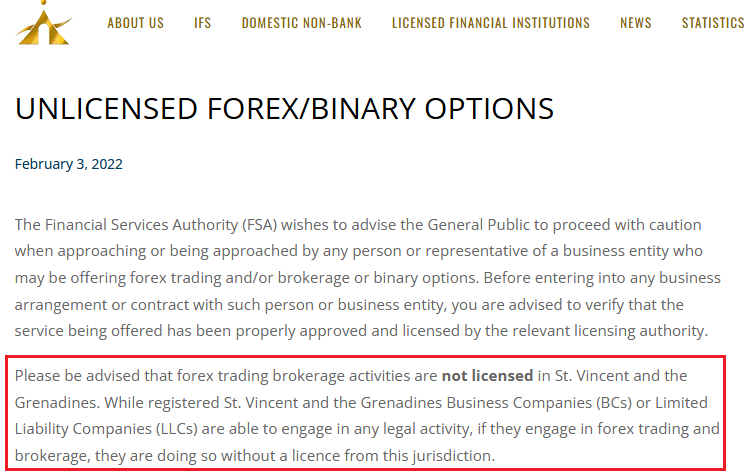

Moreover, their assertion of being a “Forex & CFDs brokerage” implies adherence to regulations governing these financial instruments. However, the Financial Services Authority (FSA) of St. Vincent and the Grenadines explicitly states on their website that they do not regulate the forex market. This raises serious doubts about Swiss Vests’ regulatory compliance and the safety of client funds.

Questionable Ownership: A Pattern of Deception?

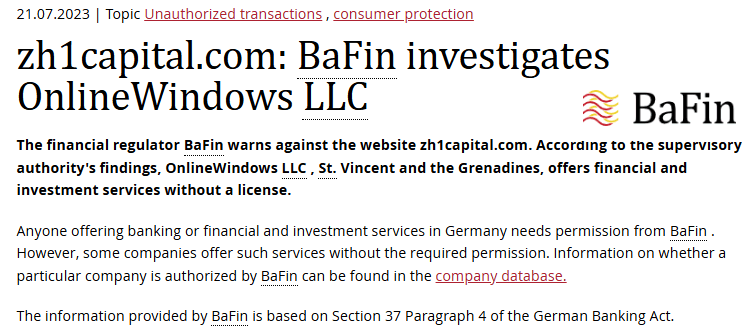

OnlineWindows LLC, the company behind Swiss Vests, has a history of operating other suspicious trading platforms, including ZH1 Capital (zh1capital.com) and Kantonvest (kantonvest.com), both of which have shut down after receiving warnings from the German Federal Financial Supervisory Authority (BaFin) and the Austrian Financial Market Authority (FMA). This pattern of creating and abandoning unregulated platforms raises serious concerns about the intentions behind Swiss Vests.

Multiple Regulatory Warnings: A Global Red Flag

The absence of regulatory supervision over Swiss Vests has not gone unnoticed. In addition to operating without authorization from the FSA SVG, the platform has received warnings from two European regulators:

- AFM (Netherlands): The Netherlands Authority for the Financial Markets has issued a warning against Swiss Vests, raising concerns about the platform’s legitimacy.

- FSMA (Belgium): The Financial Services and Markets Authority in Belgium has also warned against Swiss Vests, The FSMA strongly advises against responding to any offers made by this trading platform.

These warnings from reputable financial authorities serve as a critical alert for potential investors, highlighting the risks associated with engaging with an unregulated platform like Swiss-Vests.com.

Trading Platform and Account Types:

Account Types:

Swiss Vests offers five distinct account types:

Basic Account:

- Minimum Deposit: Not specified in the image

- Leverage: Up to 1:20

- Spreads: Varies from asset to asset

- Swaps: As low as 0.08%

- Features:

- 24/5 support

- Access to summary report every 2 months

Intermediate Account:

- Minimum Deposit: Not specified

- Leverage: Up to 1:40

- Spreads: Varies from asset to asset

- Swaps: As low as 0.04%

- Features:

- All Basic features

- 1 Analyst Training Session per month

- €1,000 dividends per month (after 3-month commitment)

- 2 Managed Account Sessions per month

Advanced Account:

- Minimum Deposit: Not specified

- Leverage: Up to 1:100

- Spreads: Varies from asset to asset

- Swaps: As low as 0.03%

- Features:

- All Intermediate features

- Advanced Trading Signals

- 2 Analyst Training Sessions per month

- €3,000 dividends per month (after 3-month commitment)

- 4 Managed Account Sessions per month

- 6 Independent Contracts

VIP Account:

- Minimum Deposit: Not specified

- Leverage: Up to 1:200

- Spreads: Varies from asset to asset

- Swaps: As low as 0.02%

- Features:

- All Advanced features

- 4 Analyst Training Sessions per month

- €7,500 dividends per month (after 3-month commitment)

- 8 Managed Account Sessions per month

- 12 Independent Contracts

- Access to Premium Trading Room

- Invitations to VIP events

- Access to summary report monthly

Elite Account:

- Minimum Deposit: Not specified

- Leverage: Up to 1:400

- Spreads: Varies from asset to asset

- Swaps: As low as 0.0%

- Features:

- All VIP features

- 8 Analyst Training Sessions per month

- €15,000 dividends per month (after 3-month commitment)

- 12 Managed Account Sessions per month

- Unlimited Independent Contracts

- Access to summary report weekly

Trading Platform:

While Swiss Vests promote its unique web-based trading platform, the absence of the famous and trusted MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms is unusual for a serious brokerage. These platforms are favored by traders worldwide for their reliability, advanced features, and customization options.

Conclusion

Given the multiple regulatory warnings and suspicious ownership history, it is strongly advised to avoid Swiss Vests. The platform’s operations raise serious concerns about its legitimacy and the safety of your investments. There are many regulated brokers that offer more safety and security, backed by strong financial regulators.

FAQ

Is Swiss Vests a regulated broker?

No, Swiss Vests is not regulated by any reputable financial authority.

What are the risks of trading with Swiss Vests?

Investing with Swiss Vests carries significant risks due to its lack of regulation and offshore base. These risks include the potential loss of your investment, difficulty withdrawing funds, and no protection from regulatory bodies.

Who owns Swiss Vests?

Swiss Vests is operated by OnlineWindows LLC, a company registered in St. Vincent and the Grenadines.

What are the account types offered by Swiss Vests?

Swiss Vests offers five account types: Basic, Intermediate, Advanced, VIP, and Elite.

Is Swiss Vests a safe platform for trading?

No, Swiss Vests is not considered a safe platform for trading. It has received warnings from multiple financial regulators, including the AFM (Netherlands) and FSMA (Belgium).