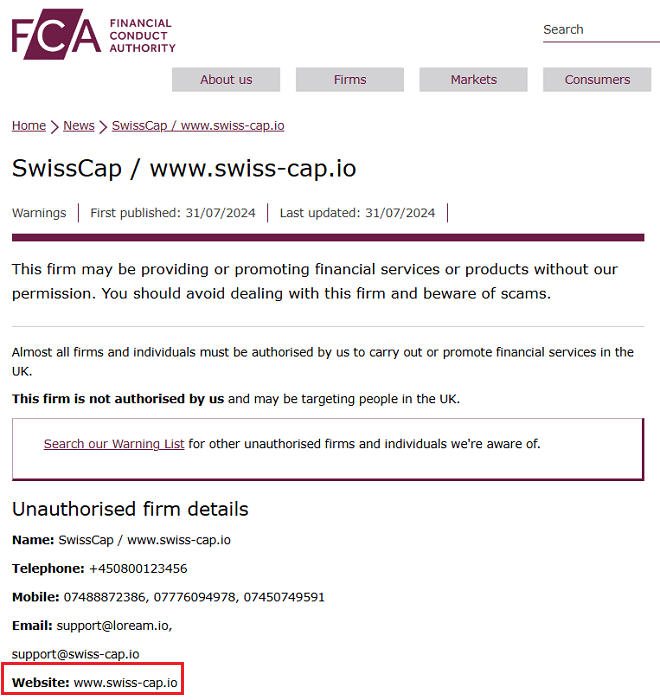

| 🏢 Company Name: | SwissCap |

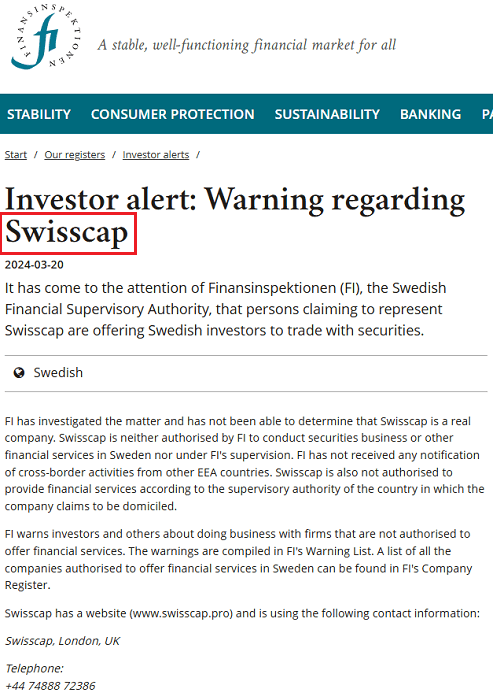

| 🌐 Website: | swiss-cap.io (previously swisscap.pro) |

| 📍 Supposed Address: | London, United Kingdom |

| 📞 Phone: | +447488872386 |

| ✉️ Email: | [email protected] [email protected] [email protected] |

Got scammed by an online company? Specialized in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation with CNC Intelligence by filling out the form below.

Introduction: SwissCap’s Claims vs. Reality

SwissCap positions itself as a global financial markets trading platform, offering access to Forex, CFDs (Contracts for Difference) on shares and ETFs, metals, commodities, and futures. They emphasize their innovative platform and diverse trading instruments.

However, a closer look reveals a series of red flags, including a lack of regulatory oversight, questionable practices, and concerning ties to known scams.

Is SwissCap Regulated?

SwissCap claims to be headquartered in the United Kingdom. However, they are not regulated by the Financial Conduct Authority (FCA), the UK’s financial watchdog.

SwissCap’s regulatory status raises significant red flags. Despite claims of global operations, it lacks authorization from any reputable financial authority. This absence of regulation means your investments are unprotected and susceptible to potential fraud or mismanagement.

Multiple Regulatory Warnings

Numerous financial regulators have issued warnings against SwissCap, including:

- Financial Conduct Authority (FCA): The FCA warns that SwissCap is not authorized to offer financial services in the UK.

- Comisión Nacional del Mercado de Valores (CNMV): The CNMV issued a similar warning, highlighting the platform’s illegal operations in Spain.

- Finansinspektionen (FI): The Swedish financial regulator has also flagged SwissCap as an unauthorized entity.

- Hellenic Capital Market Commission (HCMC): The HCMC has warned investors about the risks associated with dealing with SwissCap.

- The Federal Financial Supervisory Authority (BaFin): warns consumers about the series of platforms with the slogan “Step Into the Trading Arena with Confidence”

- The Autorité des marchés financiers (AMF): has issued a warning against swiss-cap.io

These warnings from reputable financial authorities are crucial for investor protection, as they serve as a red flag indicating that the platform may not adhere to necessary financial regulations or safeguards.

Lack of Transparency: A Red Flag for Potential Scams

SwissCap operates with a concerning lack of transparency. The website provides no information about the company’s legal status, registration details, or the individuals behind the operation. This opacity makes it impossible to verify their claims or assess their credibility.

Furthermore, the complete absence of terms and conditions on the website is a major concern. These legal documents are essential for outlining the rights and responsibilities of both the platform and the trader. They cover crucial aspects like deposit and withdrawal procedures, dispute resolution mechanisms, and the platform’s liability in case of errors or losses.

Shifting Identities: A Trail of Dodging Accountability

SwissCap (swiss-cap.io) has a history of changing domain names in response to regulatory warnings, which raises significant concerns. This tactic is commonly employed by fraudulent trading platforms attempting to evade regulatory warnings and continue operations despite being identified as unlawful entities.

The previous domain, swisscap.pro, was likely abandoned due to regulatory pressure, further casting doubt on the platform’s legitimacy.

SwissCap Account Types

Swiss-Cap.io offers three distinct account types designed for different levels of traders:

- Standard Account:

- Minimum Deposit: $5,000

- Minimum Spread: From 1.5 pips

- Maximum Leverage: Up to 1:200

- Features: 24/5 customer support, introductory call with a personal account manager

- Silver Account:

- Minimum Deposit: $25,000

- Minimum Spread: From 1.5 pips

- Maximum Leverage: Up to 1:300

- Features: Personal Account Manager, Investment research & analytics from Trading Central

- Gold Account:

- Minimum Deposit: $100,000

- Minimum Spread: From 0.8 pips

- Maximum Leverage: Up to 1:400

- Features: Personal account manager, investment research & analytics from Trading Central, Monthly session with a senior market analyst

Connections to Known Scams: A Familiar Pattern

SwissCap’s website template and operational model bear striking similarities to other known scam platforms, such as TitanWealth24, Omega Capital Markets, GFinMarkets, and ETFInvest. This suggests that SwissCap may be part of a larger network of fraudulent operations using similar tactics to deceive investors.

Conclusion: Trading with SwissCap is Risky

Given the multiple regulatory warnings, lack of transparency, concerning ties to other scams, and dubious website practices, it is strongly advised to avoid SwissCap. The risks associated with this unregulated platform are significant, and investors could face substantial losses.

Prioritize your financial security by choosing a regulated broker with a proven track record and transparent operations.

FAQ

Is SwissCap regulated?

No, SwissCap is not regulated by any reputable financial authority and has received multiple warnings.

What are the risks of investing with SwissCap?

Investing with SwissCap is risky due to its unregulated status, lack of transparency, and negative user reviews.

Has SwissCap been flagged by financial regulators?

Yes, the FCA, CNMV, FI, BaFin, AMF and HCMC have all issued warnings against SwissCap.

What trading platforms does SwissCap offer?

SwissCap offers a proprietary web-based trading platform and mobile app.

Why has SwissCap changed its domain name?

The company has changed its domain name multiple times, likely to evade regulatory scrutiny and continue operating despite warnings.