| 🏢 Company Name: | Albi Corporation Ltd |

| 🌐 Website: | capivo.com |

| 📍 Supposed Address: | Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands MH96960 |

| 📞 Phone: | +56225708616 +552135002509 +5117070505 +5078365240 +525546319724 |

| ✉️ Email: | support@сapivo.com |

Capivo presents itself as a global trading platform, offering access to forex, commodities, indices, and cryptocurrency markets. However, the platform operates as an offshore broker, based in the Marshall Islands, a jurisdiction known for its lax financial regulations. This raises immediate concerns about investor protection and the platform’s legitimacy.

The Marshall Islands Connection: A Haven for Unregulated Entities

Capivo is operated by Albi Corporation Ltd, a company registered in the Marshall Islands, specifically at Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands MH96960. While this exotic location may seem appealing, it’s important to understand the implications of trading with an offshore broker.

The Marshall Islands has a reputation for providing a haven for companies seeking to avoid strict financial regulations. This lack of oversight means that your investments are not protected by the same safeguards as those offered by brokers operating in jurisdictions with more robust regulatory frameworks.

Capivo’s Trading Offerings

Capivo offers a diverse range of trading opportunities for both novice and experienced traders. With over 250 CFDs available, investors can diversify their portfolios across various asset classes, including currency pairs, commodities, indices and cryptocurrencies. The platform is accessible via a user-friendly web-based interface or a convenient mobile app, allowing for trading on the go.

To accommodate different investment levels and trading styles, Capivo offers three account types:

- Basic (500€-5,000€): This entry-level account provides access to over 250 instruments, negative balance protection, and 1:200 maximum leverage.

- Standard (5,000€-10,000€): This account offers the same features as the Basic account but increases the maximum leverage to 1:400.

- Premium (10,000€+): The Premium account includes all the features of the Standard account, along with a higher maximum leverage of 1:600 and a personal account manager.

All account types include 24/5 live support, free daily analysis, and instant execution.

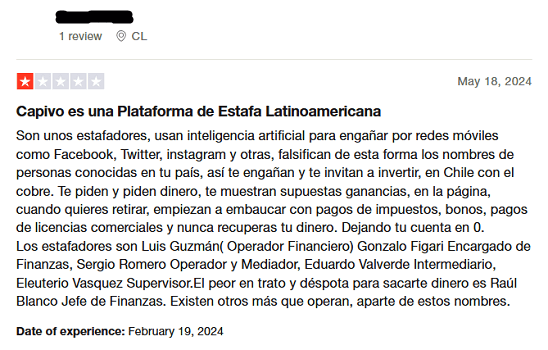

Targeting Latin American Investors

A notable observation is that Capivo appears to be actively targeting investors from Central and South America, particularly countries like Brazil, Peru, Chile, Panama, and Mexico. This is concerning because these countries have their own financial regulators in place to protect investors, such as the Comissão de Valores Mobiliários (CVM) in Brazil, the Superintendencia del Mercado de Valores (SMV) in Peru, the Comisión para el Mercado Financiero (CMF) in Chile, the Superintendencia del Mercado de Valores (SMV) in Panama, and the Comisión Nacional Bancaria y de Valores (CNBV) in Mexico.

Capivo’s operation in these regions without obtaining the necessary licenses from these local authorities raises serious questions about its legitimacy and respect for local regulations. This disregard for local oversight exposes investors in these countries to heightened risks and potential financial harm.

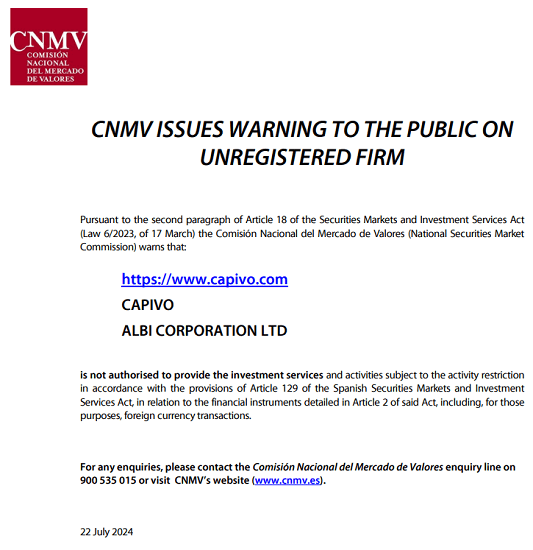

CNMV Warning: Unauthorized Operations in Spain

The Spanish financial regulator, the Comisión Nacional del Mercado de Valores (CNMV), has issued a warning against Capivo, stating that the company is not authorized to provide investment services in Spain. This warning underscores the risks associated with dealing with an unregulated offshore broker.

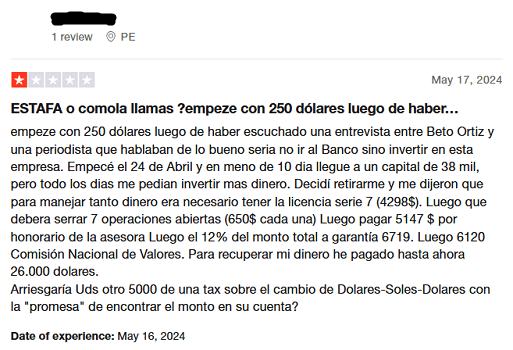

Overwhelmingly Negative User Reviews: A Loud and Clear Warning

A brief look at Capivo’s Trustpilot page paints a grim picture. The platform is flooded with negative reviews from users who describe experiences ranging from frustrating to devastating. Many users report significant difficulties withdrawing their funds, encountering delays, unexplained fees. Additionally, many claim that Capivo’s representatives employ aggressive tactics, pressuring them to invest more and more money.

The overall sentiment on Trustpilot is overwhelmingly negative, with many users labeling Capivo as a scam. These alarming reviews raise serious doubts about the platform’s legitimacy, operational practices, and commitment to protecting investors’ funds.

Victim to an Online Scam?

CNC Intelligence specializes in uncovering complex financial crimes and tracing lost assets. Don’t let scammers get away with your hard-earned money. Take the first step towards justice. Get a free consultation by filling out the form below.

Conclusion: Proceed with Extreme Caution

Considering Capivo’s offshore location, lack of regulation by a reputable authority, the CNMV warning, limited transparency, and mixed user reviews, it’s strongly advised to exercise extreme caution before investing with this platform. The potential risks associated with offshore, unregulated brokers are significant, and there are many other reputable brokers available that offer greater transparency and security for your investments.

FAQ

Is Capivo a regulated broker?

No, Capivo is not regulated by any reputable financial authority.

Where is Capivo based?

Capivo is an offshore broker based in the Marshall Islands, a jurisdiction known for lax financial regulations.

What are the risks of trading with Capivo?

Investing with Capivo carries significant risks due to its lack of regulation and offshore status. These risks include the potential loss of your entire investment, difficulty withdrawing funds, and limited recourse in case of disputes.

Why has the CNMV issued a warning against Capivo?

Capivo is not authorized to offer financial services in Spain.

Should I invest with Capivo?

Given the significant risks and red flags associated with Capivo, it is strongly advised to avoid this platform.